AML Verification & Payment Processing Improvements

1763137176894

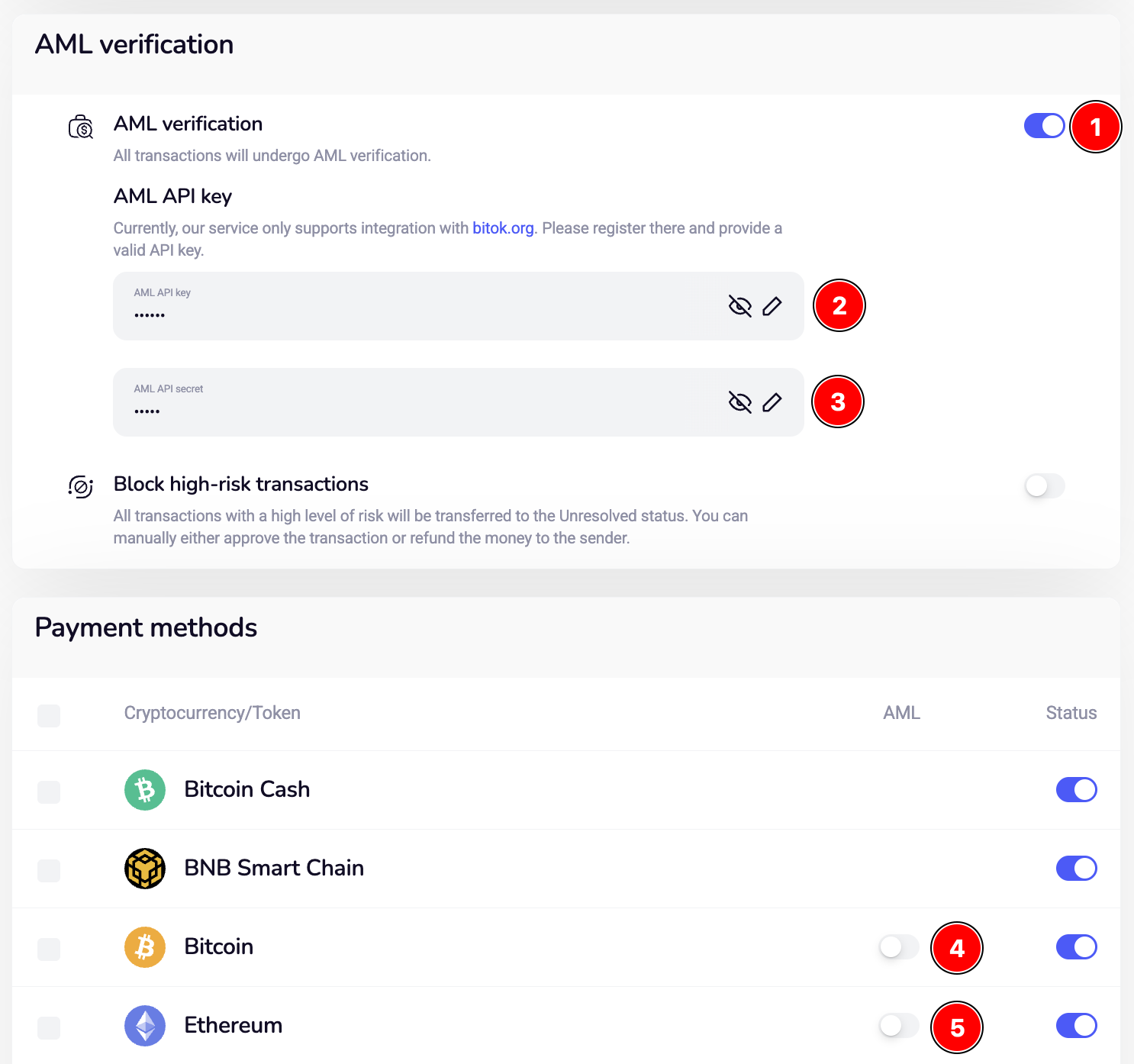

AML Verification Integration

We’ve introduced AML verification in the Gateway Settings section (Account → Gateway). The platform now supports seamless integration with BitOK.org for automated Anti-Money Laundering (AML) checks.

Key Features

When AML verification is enabled and a valid API key is added, the option to enable AML checks for BTC and ETH becomes available, and all transactions in these currencies are automatically sent for AML risk assessment.

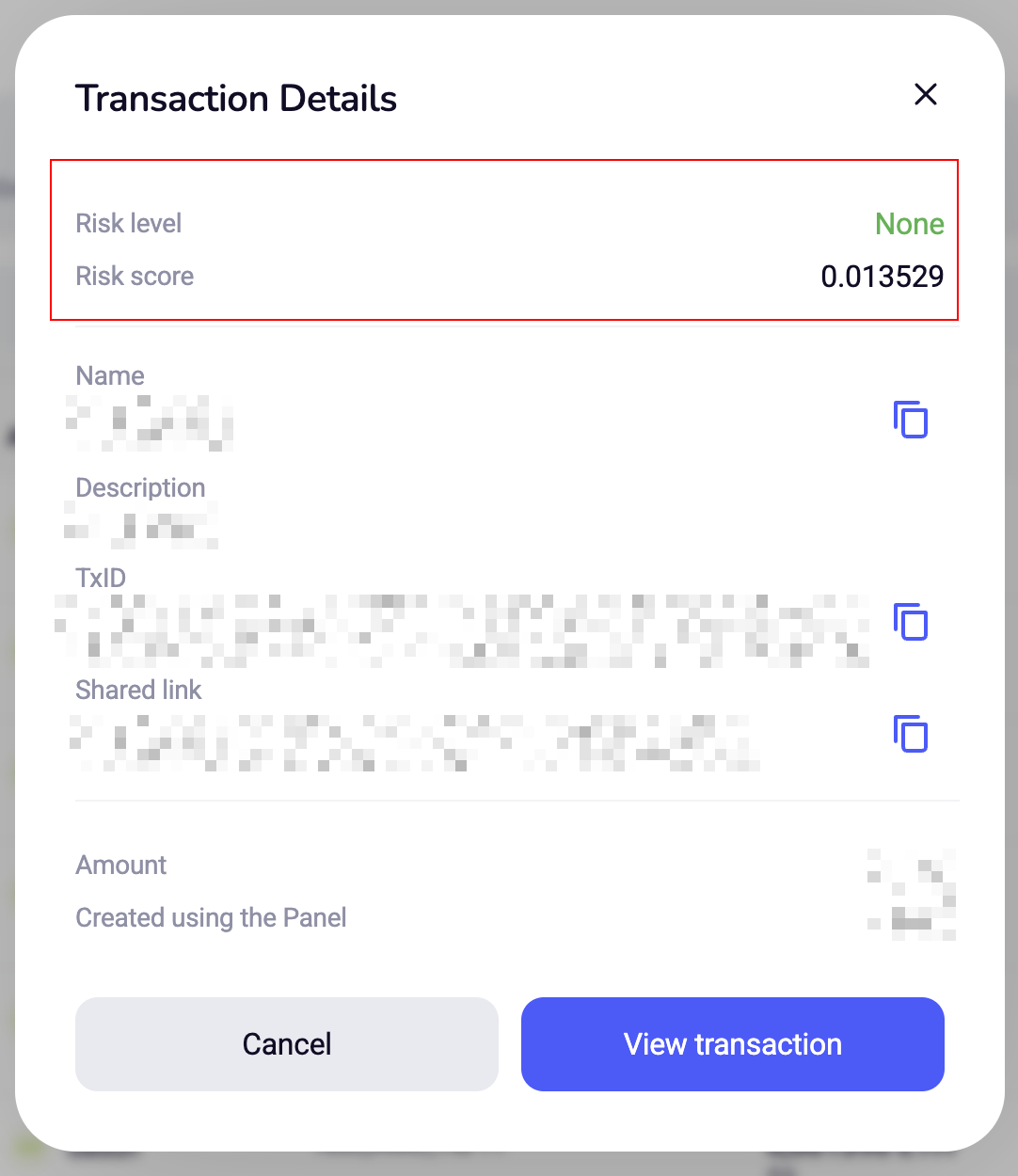

After verification, the transaction details display one of the following risk levels — none, low, medium, high, or severe — along with a risk score and a colored icon (green, yellow, or red) that reflects the risk severity.

Transactions with high or severe risk are automatically moved to the Unresolved (Risk score) status, awaiting manual action.

Resolve — unlocks the address and changes the transaction status to Resolved.

Refund — refunds the full transaction amount while displaying the risk level and score.

If the number of available AML checks is exhausted, an error message appears: “No available AML checks.”

Blocking High-Risk Transactions

When blocking is enabled, only high-risk transactions (high or severe) cause the associated address to be marked as “dirty”, preventing its use for new deposits, invoices, or payments.

When blocking is disabled, high-risk transactions (high or severe) still appear as Unresolved, but addresses are not marked dirty, and partial refunds are allowed.

Other Improvements

Smart contracts recently introduced a multisend feature that enables sending tokens to multiple recipients within a single transaction. We have improved the processing of ERC20 and BEP20 transactions to fully support this feature and fix related errors.

Did you like this update?

![]()

![]()

![]()

Leave your name and email so that we can reply to you (both fields are optional):